China Foreign Ownership and BC Resources by Kevin Hinton and Ryan McKenzie – Date not provided https://www.bcbusiness.ca/china-foreign-ownership-bc-resources Does allowing non-B.C. enterprises to buy increasing chunks of the companies producing our resource commodities result in a loss of control over how those resources are developed?

B.C.’s natural resources are being gobbled up by foreign entities at a record pace. Increasingly, those entities are controlled by governments, such as China’s, that may have motives beyond mere profits.

Former B.C. Premier Bill Bennett said in 1979 that B.C. was not for sale. He made that famous declaration in reaction to news that Canadian Pacific Investments Ltd., the Montreal-based subsidiary of the railway company, was seeking to increase its already large ownership position to a controlling interest in MacMillan Bloedel Ltd., the province’s number one forest products company.

That was too much for Bennett. At the time, CP was already a major player in the province and gaining control of MacMillan Bloedel would make it by far the biggest, with headquarters in Central Canada. Bennett vetoed the deal using the provisions of the B.C. Forest Act, which required government approval for any transfer of forest leases from one corporation to another.

“We’re clarifying government policy in declaring there is a point at which a company can be too large in a certain area,” Bennett told the legislature on June 25, 1979. “That’s the policy of this party and this government . . . that is public policy from the premier of the province of British Columbia.”

Fast forward a couple of decades and many would argue that the province is not only for sale, but large pieces have been sold – and this time with government acquiescence, if not approval. Consider the following:

• With the provincial government’s blessing, MacMillan Bloedel was bought for $US 2.45 billion in 1999 by Weyerhaueser Inc., a huge U.S. forest products company. There was nary a ripple of comment.

• In 2002, North Carolina-based Duke Energy Inc. paid $US 8 billion for control of Westcoast Energy Inc., the company that runs the natural gas pipeline system from northeast B.C. gas fields to the rest of the province, and to export markets in the U.S. There was little public comment.

• Kelowna-based Inland Natural Gas, having just picked up BC Hydro’s natural gas distribution network and the Trans Mountain pipeline system, was bought in 2005 by U.S.-based Kinder Morgan and twice renamed, first BC Gas Inc., then Terasen Gas Inc. Kinder Morgan soon spun Terasen’s natural gas assets off to Fortis Inc., a Canadian company headquartered in Newfoundland. But Kinder Morgan kept the piece it wanted: Inland’s ownership stake in Trans Mountain Pipeline, the company that ships crude oil and refined products to Vancouver from Edmonton. There was no public outcry over this either.

• In a transaction still mired in controversy, the B.C. government in 2004 completed the sale of debt-ridden B.C. Railway Co. to Canadian National Railway Co. for $1 billion. As it is now structured, CN is as much an American company as it is Canadian. There is significant and ongoing public comment on this transaction, although the controversy has less to do with foreign control than it does with politics.

Globalization has expanded the reach of “national” companies everywhere, with many now taking on the more accurate “multinational” moniker. Of course nationalist sentiment still exists – witness the American reaction to a disastrous oil spill in the Gulf of Mexico and the British company, BP Petroleum, that was responsible for it. But governments now seem satisfied that they can control foreign-owned private companies through regulation.

Today, the focus of the debate has shifted from concern over a private-sector change in share ownership to concern over acquisitions and investments by state-owned enterprises and sovereign wealth funds. While a private-sector move is transparent – they all want to make more money – a state-controlled enterprise may have additional agendas that are contrary to the host nation’s interests. Increasingly, these state-owned enterprises are from the People’s Republic of China.

In the last two years, Chinese state investments in Canada have included a $1.9-billion investment by PetroChina Co. Ltd. in Athabasca Oil Sands Corp., a $4.65-billion investment by Sinopec Corp. in oilsands producer Syncrude Canada Ltd., a $1.25-billion investment by China Investment Corp. in Calgary-based Penn West Petroleum Ltd. and a $679-million takeover of Vancouver-based Corriente Resources Inc. by a Chinese consortium.

In addition, it was announced in January 2011 that Sinopec Corp. is among a group of investors providing $100 million to jump-start Enbridge Inc.’s proposed $5.5-billion Northern Gateway pipeline project, designed to carry oilsands crude from Alberta to a tanker port in Kitimat and on to Asian markets.

These kinds of investments are taxing Canada’s foreign investment rules and have already sparked a review. At issue is whether or not the country needs to use different criteria in assessing the benefits of a state-owned company’s investment as opposed to a straightforward private-sector investment.

While there has been some debate on the question of ownership of Canada’s natural resources, nary a word was uttered by any of the political candidates running for office in the May 2 federal election. And very little work has been done to help explain to the general public what the issues are and why they should care.

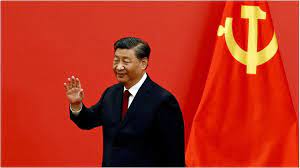

Image: Peter Holst

John Bruk broke with the Asia Pacific Foundation,

arguing that investments from Chinese state-

controlled companies must be better regulated.

The growing number of Chinese investments

In January 2011, Pascale Massot, a doctoral student in UBC’s political science department, prepared a paper for Vancouver’s Asia Pacific Foundation of Canada looking at the growing number of investments made by state-owned Chinese enterprises. She recommended that governments provide clarity around how such investments should be treated.

“Since the summer of 2009, at least five Chinese state investments in Canada in the energy and mining sectors have totaled more than $10 billion,” wrote Massot. “Those investments were completed unhindered (most did not meet the minimum requirements for a review under the Investment Canada Act). Confirming a sustained interest in investing in Canada, the China Investment Corporation (a sovereign wealth fund) unveiled plans to open its first overseas corporate location in Toronto on January 12, 2010.”

Massot went on to call for changes to Canada’s review process to better reflect the new investment environment: “It is important for the Investment Canada Act to remain up to date in the face of the rapid evolution of state-owned investments globally. It is also particularly important to get this right, in light of the growing importance for Canada of Chinese state-owned and private investment.”

For B.C., there are three such investments that illustrate the debate. In July 2009, China Investment Corp. put $1.74 billion into Vancouver-based Teck Resources Ltd. for a 17.5 per cent equity stake. Then, in February 2011, PetroChina announced it was investing $5.4 billion in one of EnCana Corp.’s prolific shale gas properties in northeastern B.C.; rather than making an equity investment in EnCana, China elected instead to go the joint-venture route. The third investment, announced in the spring of 2011, has a private-sector consortium of Chinese companies putting up $1 billion to develop metallurgical coal from B.C.’s northeast. Although not a pure example of a state-owned enterprise, there is some state involvement, and the deal seems designed to do an end run around mining companies and lock up the coal supply for China’s steelmaking industry.

Whether or not all these investments from China are a good thing for B.C. is an open question. Is the $5.4-billion investment in EnCana’s shale gas designed to maximize returns from the sale of the gas to the highest bidder, or is it designed instead to lock up the supply of gas, at a relatively low price, and move it to China via a liquid natural gas plant in Kitimat? Only a month after announcing the Chinese investment, EnCana said it would acquire a 30 per cent interest in that LNG export terminal, now in its final planning stages.

It’s that potential for conflict of interest that has a few people worried. Jock Finlayson, executive vice-president of the Business Council of B.C., appreciates the “investment renaissance” that B.C. is now experiencing, but recommends a cautious approach.

“Canada needs to look at this,” he says. “I don’t know what the right answer is, but I do agree that the private-sector rules don’t apply to state-owned organizations, and it’s not just the Chinese. It requires an explicit look. Do we hold them to a higher test? They are going to have to do it sooner rather than later.”

John Bruk, who 27 years ago co-founded and headed the Asia Pacific Foundation, pulls no punches on this topic. He sees a need for some concerted action before too many horses have fled the barn. Bruk has prepared a comprehensive analysis of the track record of the foundation; he believes the government-funded organization needs to be re-energized in part because of China’s growing economic influence, and believes it needs to do much more to help Canada address an unsustainable trade deficit with China. (Disclosure: I provided editing services for Bruk on this paper.)

“Is trading our ownership and control of core assets for more consumer goods, resulting in unsustainable trade deficits, good for Canada?” Bruk asks in his report. “Are we jeopardizing prosperity for our children and grandchildren while putting at risk our economic independence? In my view, this is exactly what is happening.”

Bruk describes the EnCana investment as a good case in point: “It is just the latest in a series of investments by China that should spark a serious debate in this country about Canada’s willingness to accept what appears to be an asset purchase by an agency of a foreign government. It is perhaps the first transaction in which a sale of a natural resources asset is dressed up in the sheep’s clothing of a joint venture with a view to neutralize any opposition.”

Bruk has similar problems with the Teck investment, questioning why it was necessary to seek Chinese investment for a Canadian mining company (one of the few that hasn’t been taken over outright) when there is plenty of investment capital within our borders.

“Considering that Teck produces base metals and coal, commodities in great demand by China, was Canada in such a desperate state that Teck had to accept money from the China Investment Company to find the needed bridge financing? A number of our public employees’ pension funds had plenty of capital for such a promising investment. How promising? CIC bought 101.3 million Teck class B shares at $17.21; in less than two years, those shares increased to $53, a return of over 200 per cent. Instead, our public pension fund managers are going abroad seeking investments as if there were no opportunities in Canada. Is it any wonder foreigners would like to acquire more of our resource assets?”

Bruk is at odds on this topic with his old employer, the Asia Pacific Foundation. Kenny Zhang is a senior research analyst with the foundation and sees no cause for concern here.

“It doesn’t matter where [the investment] comes from – it always has positive and negative effects. We should treat [state-owned investors] equally as with any investment. They have to follow Canadian law. The state-owned company wants the high return for the investment, and also has a strategic need for resources. We must clear up the message. We are an open economy. The Chinese are watching this very closely.”

Foundation officials are sensitive to this topic, and worry about the public perception out there around investments from China. After the Harper government’s very high-profile rejection last fall of a bid by Australia-based BHP Billiton to take over Saskatchewan-based Potash Corp., the foundation commissioned Pascale Massot’s review of state-owned enterprises and their interest in Canada. Prime Minister Harper rejected the takeover bid on “national security” concerns, but only after the governments of Alberta, Saskatchewan and Manitoba all argued strongly that the takeover was not in the national interest. (B.C. took no position on this transaction.) One of Massot’s findings was that politics played a large role in Harper’s decision, and that that needs to change.

[pagebreak]

In April, the foundation released the results of a survey it had commissioned to assess Canadians’ comfort level with investment from a number of countries, including China. The results were unsettling for those who see Chinese investment in Canada’s resource sector as a good thing. It showed that more Canadians see China as a threat (57 per cent) than an opportunity (43 per cent), and that such sentiment is growing. More than 75 per cent said they were opposed to a Chinese state-owned company taking a majority position in a Canadian company.

“There is a yawning discrepancy between the sentiments that Canadians have for Asian countries and the role that they see Asia playing in Canada’s economic future,” said Yuen Pau Woo, the foundation’s president and CEO, in a press release accompanying the poll results. He went on to castigate federal politicians, in the middle of campaigning, for not paying enough attention to the issue: “In an election campaign that has largely been devoid of discussion on international issues, the poll findings suggest an urgent need for political leadership on a Canadian response to the shift in global power towards Asia. It is not enough to give lip service to the notion that Canada is an Asia Pacific nation. There is an urgent need for improved awareness, greater activity and better policy. We need a national conversation on Asia to better equip Canadians to respond to the rise of Asia, and to make Canada more fully a part of the Asia Pacific region.”

Whether people agree with the APF’s strong promotion of a green-light policy for state-owned investments or follow the more cautionary approach recommended by the Business Council of B.C., there is little help coming from federal politicians. They are largely silent on the issue.

Former federal industry minister Tony Clement was asked in April to comment on the Conservative government’s current thinking on how to treat investments from state-owned enterprises. The government in fact created a Competition Policy Review Panel in 2007 and published its recommendations in 2008. None of the recommendations have been implemented, including one calling for better communication on how the government makes decisions about these kinds of investments. Clement declined the interview request; he too was busy campaigning for re-election.

B.C.’s newly appointed energy minister, Rich Coleman, on the other hand, doesn’t hesitate to offer his opinion on Chinese state-owned investment in the energy sector. Asked if he has any concerns, Coleman responds, “I don’t think so. These companies, like China National Oil Corp., have established partnerships with industrial players here and elsewhere. They will advance development of our resources, and they’ll follow our rules and environmental regulations. We haven’t said to one company you’re not welcome, and another is.”

Coleman sees no conflict in a Chinese state-owned enterprise holding a large piece of a B.C. shale gas field: “Well, they would make the investment at the best price they could so they could get access to the gas at the best price they can. I don’t think state-owned corporations versus private ones have any other goal than that.” Coleman points out that the price paid for natural gas in China is three times higher than the North American price and that the province’s royalty take would increase with sales to China.

James Brander, Asia-Pacific Professor of International Business in UBC’s Faculty of Commerce, shares Coleman’s view of the investments in general and the EnCana deal in particular. But he also has some cautionary notes.

“Of course there is a potential conflict. But strictly speaking, the terms on which they enter this agreement, under Canadian law, would require them to operate in the interests of the shareholders,” he says. “It’s not legal in Canada for a foreign government to, either directly or by proxy, own an asset and use it for the explicit benefit of the foreign country at the expense of the shareholders.

“But it’s not as though we have investment police looking into every single investment,” he continues. “They could exercise some pressure. But at this level I wouldn’t be concerned. We are talking about [with EnCana] a 50 per cent ownership. I’d be more concerned about majority ownership. It is important to keep our eye on that conflict of interest. We do have laws to prevent it, but we need to keep an eye on it.”

While John Bruk disagrees with the APF’s current position on Chinese state-owned investors, he agrees there’s a need for a national discussion on the topic. And he believes there’s some urgency for it. Canada’s trade deficit with China skyrocketed from $1.1 billion in 1995 to $31.2 billion in 2010, making it our largest by far. During those 16 years, exports to China have grown by a factor of less than four while China’s exports to Canada have grown by a factor of almost 10. This trend, says Bruk, is “a recipe for impoverishment of our country.”

“Is it any surprise that President Hu expressed China’s desire to double its bilateral trade with Canada by 2015?” Bruk asks. “Assuming that both exports and imports double, which is optimistic from a Canadian point of view, considering the above ratios, our trade deficit would grow from $31.2 billion last year to $62.4 billion by 2015 – a boon for China, not for Canada.”

Over the next decade, B.C. is pinning its hopes on a resurgence of interest from Asian nations looking for commodities – whether it’s coal for steel, natural gas and oil or forest products. But the province faces the same dilemma it has faced for most of its existence: Does allowing non-B.C. enterprises to buy increasing chunks of the companies producing our resource commodities result in a loss of control over how those resources are developed?

Premier Bennett, nearly 35 years ago, decided that allowing out-of-province control of our economic engine was too great a risk to take – and back then, the out-of-province player in question was Canadian and privately owned. With state-owned enterprises now threatening to lock up those resources with perhaps a different agenda in mind, is there enough consideration being given by governments to all the ramifications? The simple answer, it would appear, is no.